How MSTR "Works"

Explaining the MicroStrategy strategy, its Bitcoin premium, and why it’s more than just a Bitcoin proxy

Imagine someone, centuries ago, telling all their neighbors every year, “Give me your gold for whatever it’s worth in wampum shells today. At some point in the future, I’ll owe you those shells.” Let’s say this person also knows that gold is becoming increasingly scarce, and that wampum shells happen to be appearing on nearby beaches more and more frequently every year. What is this person doing?

Basically, they’re taking on debt in the form of a depreciating asset (wampum shells) to buy an appreciating asset (gold). It’s a great bet. They think something like, “The increasing supply of wampum shells will reduce my relative debt burden, while the decreasing supply of gold will increase my personal wealth.” In hindsight, this would be a brilliant move right?

Well, there’s a company out there that’s basically implementing this strategy today. Let’s talk about that.

MSTR in a wampum-shell

MicroStrategy (MSTR) is maybe one of the most innovative / controversial businesses out there today. Remember that gold-for-wampum exchange? That’s essentially what MSTR is doing in modern times - using US dollars (a currency it expects to depreciate) to buy Bitcoin (an asset it expects to appreciate). A brief summary goes something like:

It’s led by Michael Saylor, a high-profile, often polarizing Bitcoin advocate

It’s “technically” a business intelligence software company (whose software revenue has been declining / losing money lately)

In recent years, MicroStrategy has effectively shifted its core growth plan to accumulating as much Bitcoin as possible, making Bitcoin its primary treasury asset.

It buys Bitcoin through two fundamental tactics - debt financing (issuing low-interest convertible bonds) and equity financing (At-The-Market sharing offerings aka ATMs).

As of 9/20/24, Microstrategy holds 252,220 BTC on its balance sheet, roughly 1.2% of the total Bitcoin supply of 21,000,000 BTC

If you want more background on it, there are better summaries and articles around. My goal today is to roughly explain how MicroStrategy’s STRATEGY with Bitcoin “works” - because, if it works as planned, there is a lot of growth ahead. If it doesn’t…well, we’ll get there.

What’s up with the NAV ?

What I often hear is confusion around what exactly Microstrategy is doing, and how their overall plan makes any sense - in relation to Bitcoin ups and downs, in relation to its underlying software biz, in relation to [insert almost anything]. But most frequently, I hear confusion related to the MSTR “NAV” - this is the big one. What is the NAV and why does it matter?

Below, I’ll aim to give a simple explanation as I see it. I know it’s oversimplified, but I think the framework is really useful.

A few things to note to start:

A company's NAV stands for its "net asset value" - its assets MINUS its liabilities. Call that "things you can sell or of value" MINUS "some form of debt"

Let's assume that MSTR's actual software business is valued at $0. It's not, but this will help. You could argue it's worth less (it loses money) or that it's worth more (it has future potential) but we're gonna assume $0 for simplicity. So it doesn't factor into the NAV at all.

So then, to calculate the NAV, we go like this:

NAV =

MSTR Assets (cash in US dollars on the balance sheet PLUS Bitcoin holdings value in US dollars on the balance sheet)

MINUS

MSTR Liabilities (debt in US dollars on the balance sheet)

For MSTR to "work," we have to assume that Bitcoin continues going up over time (it's the only way the company's thesis makes sense) so that's also an assumption.

Bitcoin-Buying Tactic #1: Debt Financing (Convertible Bonds)

Let’s explore the first method MSTR uses to raise dollars to buy Bitcoin - taking on debt in the form of convertible bonds. MSTR doesn’t just take out traditional loans with high interest rates. Instead, the company raises money primarily through convertible bonds - a unique type of debt instrument. These bonds offer investors a low interest rate in exchange for the option to convert their bonds into MSTR stock if the stock price rises. For instance:

In March 2024, MicroStrategy issued $800 million in 0.625% convertible senior notes due 2030.

In September 2024, they issued another $1.01 billion in 0.625% convertible senior notes due 2028.

Here’s why this is important: Convertible bonds allow MicroStrategy to access large amounts of capital at incredibly low interest rates. Investors are willing to accept these terms because of the potential upside if MSTR stock performs well (their bonds can convert to MSTR stock). In turn, this strategy aligns perfectly with MicroStrategy’s overall bet on Bitcoin’s long-term appreciation.

Convertible bonds also provide stability for bondholders. Unlike MSTR stock, which fluctuates wildly with Bitcoin’s price, the bonds generate consistent interest payments for investors. This makes them an attractive option for those who want exposure and upside to Bitcoin indirectly but without the volatility of owning shares outright.

For MicroStrategy, this structure is incredibly efficient. The bonds are denominated in US dollars - a depreciating asset - while the proceeds are used to purchase Bitcoin, a deflationary asset. Over time, as inflation erodes the value of the dollar, the relative cost of the debt decreases, amplifying the potential upside of the company’s Bitcoin holdings.

Indulge me in a pretend scenario:

Year 1 - MSTR starts as a software business worth $0 and with $0 in cash. It issues $10M in convertible bonds (debt), so now it has $10M in cash. It then uses that cash to purchase $10M of Bitcoin.

NAV = $10M BTC - $10M debt = $0 NAV

Year 2 - after 1 year, Bitcoin has had a nice growth streak, and that $10M in Bitcoin has doubled in value, now worth $20M. But the debt is still only $10M. So now...

NAV = $20M BTC - $10M debt = $10M NAV

Following its strategy, MSTR issues another $20M in convertible bonds, to get $20M in cash, that it uses to purchase another $20M Bitcoin. Thus…

NAV = $20M BTC (from before) + $20M BTC (newly bought) - $10M debt (from before) - $20M debt (newly acquired) = $10M NAV (same NAV before the new debt, but now poised for more potential growth)

Year 3 - another year, another bull run for Bitcoin! The $40M Bitcoin on its balance sheet has doubled in value, now worth $80M. But the debt is still only $30M. So now...

NAV = $80M BTC - $30M debt = $50M NAV

And so on…

As Bitcoin's value rises, MSTR benefits in two ways: the value of its existing Bitcoin holdings increases, and it can issue more convertible debt to buy additional Bitcoin. This creates a cycle where rising Bitcoin prices enable the company to acquire more Bitcoin at today's price, which ideally appreciates over time, allowing for even more debt issuance and further Bitcoin purchases.

There’s some complexity to the debt - as noted, these are convertible bonds that can turn into MSTR stock if the stock price exceeds a certain strike price. This feature makes them especially appealing to bondholders, as they get the potential upside of stock appreciation if the price rises enough to justify conversion, while still minimizing downside through regular interest payments and principal protection.

Bitcoin-Buying Tactic #2: Equity Financing (ATMs)

OK, onto tactic #2 for accumulating Bitcoin - ATMs, or At-The-Market Share Offerings. this is MSTR issuing new shares (equity) to raise cash directly from the market. The company sells shares at the current market price to investors, and the proceeds are used to buy more Bitcoin. Here’s a pretend scenario of their equity financing strategy, picking up where we left off:

Year 3 (continued) - at a $50M NAV with $80M in BTC and $30M in debt, MSTR decides to do some equity financing next. Instead of taking on more debt, MSTR issues $20M worth of new shares (equity) to the public market. This brings in $20M in cash without adding new debt. MSTR uses the $20M in cash from the equity issuance to purchase $20M in Bitcoin, increasing its total BTC holdings to $100M. Updating the NAV after this…

NAV = $80M BTC (previous holdings) + $20M BTC (newly bought) - $30M debt = $70M NAV

This $70M NAV reflects the benefit of raising cash through equity instead of adding more debt. With no new liabilities, NAV increases more than it would with additional debt financing. On the flip side, issuing $20M in new shares does dilute the shareholder pool (each share now represents a slightly smaller portion of the company’s total assets), but - key callout here - I don’t see this as real dilution because the cash raised is being used to purchase an appreciating asset (Bitcoin). Over a long enough period of time, this move should actually add MORE value per share.

Year 4 – wouldn’t ya know it, Bitcoin has doubled again! The $100M in Bitcoin holdings rises to $200M. The debt remains at $30M. Latest NAV calculation is:

NAV = $200M BTC - $30M debt = $170M NAV

The Power of Both Tactics Combined!

Using both the debt and equity tactics, MSTR can continue to increase its Bitcoin holdings, and thus its NAV. And this comes “merely” at the cost of inflationary, depreciating US dollars in both scenarios (convertible notes purchased in US dollars, and issued shares purchased in US dollars). Generally speaking, then, MSTR shareholders gain leveraged exposure to Bitcoin’s price. As MSTR’s debt and equity fuel more Bitcoin purchases, any rise in Bitcoin’s value can drive NAV and stock price growth at an even higher rate than Bitcoin itself.

What if Bitcoin drops?

If Bitcoin drops in value a lot, MSTR might start to have a problem, as its leveraged position becomes a bit risky. As Bitcoin declines, MSTR debt remains, which CAN turn into issues.

For example:

Year 5: Let’s say, going into the year, MSTR still holds $200M in Bitcoin with $30M in debt - the $170M NAV is intact from Year 4. But suddenly, Bitcoin’s value drops by 50% and thus MSTR’s Bitcoin holdings fall to $100M. Let’s update that NAV!

NAV = $100M BTC - $30M debt = $70M

In this case, the MSTR NAV has dropped by nearly 60%, which is more than the 50% decline in Bitcoin’s value. Simply put, MSTR’s debt amplifies losses when Bitcoin’s price falls. If Bitcoin keeps dropping, at some point, there’s a chance MSTR would need to sell its Bitcoin to meet debt obligations. However…

Misconception #1: If the Bitcoin price drops, MSTR will have to sell its Bitcoin to pay its debt!

It’s slightly more complicated than that. Technically, as long as MSTR can continue to pay the interest on their convertible bonds, there’s no need to sell any Bitcoin, whether it’s way up or way down or way sideways. Bitcoin’s price would need to be significanlt depressed for a long period of time for this to become a real risk. The required repayment is based on a future date and not determined by the current price of Bitcoin. Also, as long as the MSTR share price is above the convertible note strike price, those notes will convert into shares and no longer be debt. This has already happened to most of their debt. Which means that Michael Saylor has a strong incentive for the MSTR share price to be above the strike price by the bond expiration.

Misconception #2: ATMs are dilutive!

At face value, issuing new shares through an ATM program does dilute existing shareholders. For example, if you once owned 2% of the company, you may now own 1.5% due to the new shares. However, what really matters is the value behind each share:

New Capital = More Assets per Share

The cash raised from selling these new shares is used to purchase more Bitcoin (an asset with potential for significant appreciation).

If the Bitcoin purchased appreciates, the overall value of the company - and thus the value per share - can increase despite a higher share count.

Accretive Effect

If MSTR sells shares at a price above its book value (or net asset value per share), the infusion of new capital can actually raise the per-share value, offsetting or even exceeding the effect of dilution.

Long-Term Perspective

Over time, if Bitcoin’s price grows, the added BTC holdings can make the company’s total net asset value (NAV) and share price higher than it would have been without the issuance.

In other words, even though your percentage ownership is smaller, the overall “pie” can grow significantly, meaning your piece might still end up being more valuable.

Thus, while ATMs do increase the total number of shares, the key is that each new share funds the purchase of an appreciating asset. In the long run, that can provide more upside for shareholders than any short-term dilution might suggest.

Riding the waves

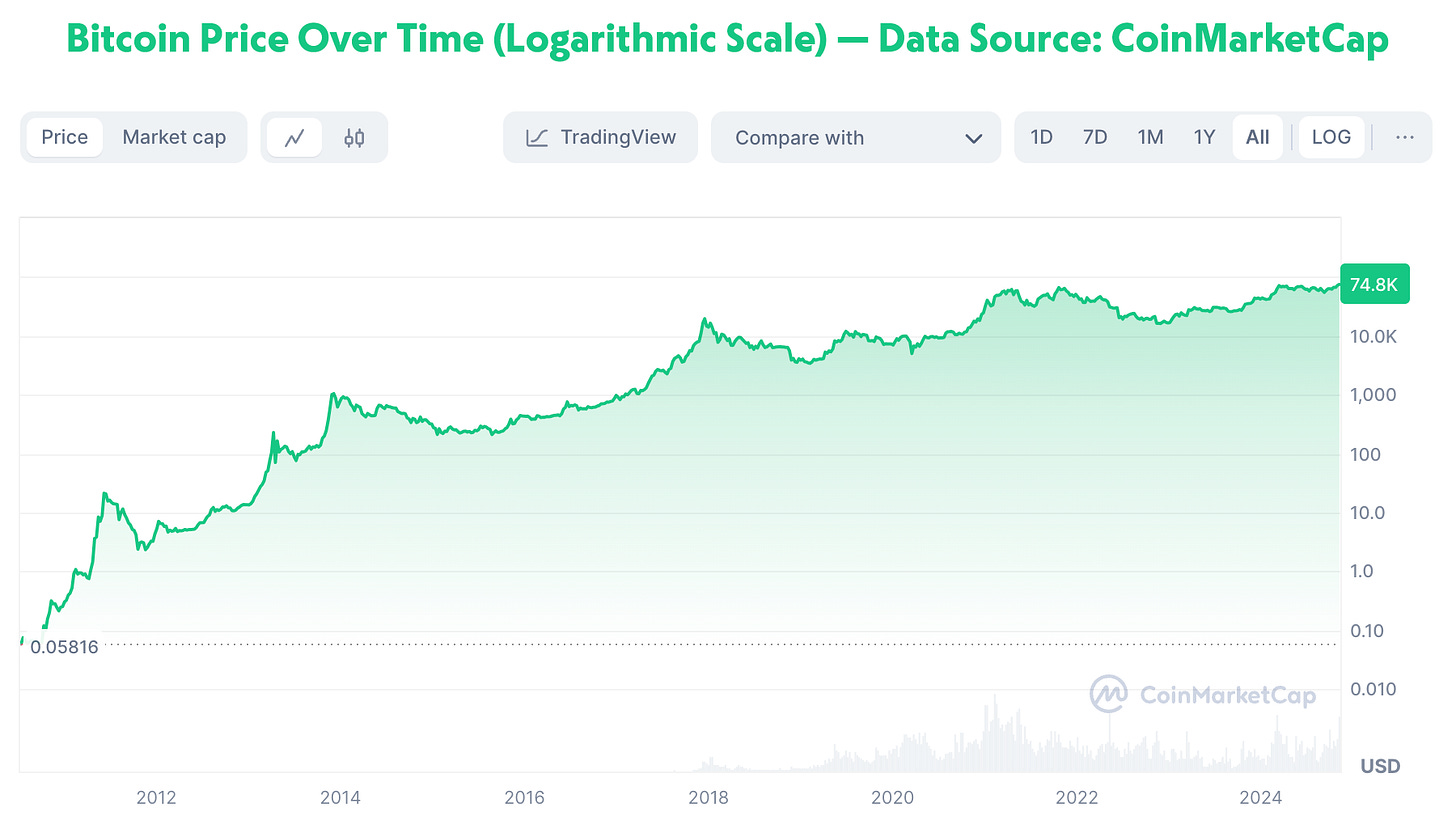

I won’t get into Bitcoin price predictions - that’s covered widely elsewhere. But I generally do think Bitcoin will continue going up a lot more than it goes down over any long enough (5+ year) time period, as it has done since it was created in 2009. Below is a logarithmic scale chart that smooths out Bitcoin’s growth, using percentage-based scaling to highlight long-term trends without being skewed by price fluctuations:

As you can see, the growth has been steadily upward over a long period of time. That said, Bitcoin is also known for high volatility, which makes MSTR (basically a leveraged Bitcoin holding company) even more volatile. For short-term investors, this can be an exciting but terrifying prospect (my investment could double or halve within a month!). Below is another chart of Bitcoin’s historical growth trajectory, this time on a linear scale. Bitcoin’s volatility gets emphasized here quite clearly, as it shows the full extent of price fluctuations over time:

I’ll spare you too many opinions here, but this volatility is why I think - along with Michael Saylor and many others - that Bitcoin is still in its infancy of growth. Volatility can be intimidating, and retail investors have yet to catch onto the long-term trends at scale. Saylor, however, sees volatility as a positive force: it signals growth potential and attracts attention, and he believes that, as adoption increases, Bitcoin’s price will eventually stabilize. For now, volatility presents both opportunity and challenge, especially for those willing to take a longer view.

More than the sum of its Bitcoin

I often hear people wonder why MSTR trades at 2, 3, or 4 (or more!) times its NAV, as it often does. My take: enough people believe in the process of leverage-fueled Bitcoin accumulation repeating successfully. MSTR shareholders gain leveraged exposure to Bitcoin’s price. As MSTR’s debt and equity fuel more Bitcoin purchases, any rise in Bitcoin’s value can drive NAV and stock price growth at an even higher rate than Bitcoin itself.

And this doesn’t even consider what MSTR (the actual operating business) could potentially achieve with that level of capital, power, and influence beyond its Bitcoin holdings. Ignoring the current software business, consider opportunities like strategic acquisitions, lending services, or the banking sector - each offering potential new revenue streams and growth avenues.

Put another way - MSTR’s Bitcoin strategy might end up being a foundation for building broader financial influence and/or operational expansion, amplifying its impact far beyond just holding Bitcoin. Or, it could just hold a ton of Bitcoin. Currently it holds about 1.2% of the TOTAL Bitcoin supply (which is permanently, forever capped at 21 million). That fact alone becomes increasingly impressive.

A bet against the dollar

This is a final point very much worth making. MicroStrategy isn’t just a bet on Bitcoin increasing in value over time due to its limited supply and increased demand; it’s also a bet against the US dollar. It’s a bet that the US dollar will lose value over time, as it has consistently done, due to inflation, over many, many decades. This is particularly relevant because MSTR’s debt is IN US dollars - essentially, it’s a strategy of taking on debt in one asset (USD) proven to lose value over time to buy a different asset (BTC) proven to gain value over time. This is a dual play on “Bitcoin go up” and “dollar go down” - boosting NAV from both sides (assets and liabilities).

Remember that story at the beginning about someone taking on debt in the form of wampum shells to buy gold? Can we all agree that would have been an AWESOME strategy at the time? I like to apply similar thinking to today 🧐

As always, I’m open to feedback, input, and discussion. Cheers.

— Alf London

NOTE: This is for educational purposes only and not financial advice. Please consult with a financial professional before making any investment decisions.